Crypto Skepticism in 2022

Request for crypto startups at the edge of the rabbit hole - for Christmas I got a guide to "how to write unpopular takes online", and this is the result.

During the holidays, I found myself at a strange inflection point - while I’ve usually been the skeptic at the table, I was defending new crypto projects at dinner. I guess you either die a hero, or live long enough to tell other people which crypto projects you’re into at the bar. 1

Crypto discourse seems to be up in arms in ways other tech. discourse isn’t - people either are all in (staking bluechips and altcoins, buying NFTs, BAYC avatars, voting in DAOs, commenting NGMI or FUD), or think we’re at the tipping point of a scam (pointing to DOGE and rug pulls, linking to AirDrop fraud, gleeful comments on BTC volatility and ponzi schemes, commenting “right click save”). Within crypto, the discourse on momentum and incentives can also get heated (e.g. winter holiday Jack vs VC tango).

Very few people I know, especially people also worried about inflation, are staking BTC and bluechips with no strong opinions on the rest of the cryptoverse (or perhaps this is the silent majority.) Very few people who spent time “going down the rabbit hole” made their way back and posted publicly. 2 It’s much easier to find informed pro-crypto takes than informed, anti-crypto takes (although perhaps unsurprisingly, it’s quite easy for sanity and skepticism to be mistaken for criticism online, and sometimes “balanced takes” are in fact meant as such).

This is not a “speculation” or a “wagmi” post- there are plenty of those online. Balanced takes are hard especially when there are fully vested interests that discredit the strengths of the positions, no matter how informed they are (e.g. Vitalik on Etherum, or Munger on fiat).

This is my attempt at summarizing what I think prevents a lot of people from fully on ramping into crypto, and some of my own outstanding questions on where we are headed in 2022.

In other words, this is a steelmanned case for being skeptical of crypto, and vice versa.3 (Probably will do wonders for my popularity online - oh well.)

This post is probably only interesting to people who are crypto-curious but want to do their homework, or people in web3 who want to consider the sources of skepticism for mass adoption. I found some great starter reports (which I’ve attached below) that are much better-informed than mine.

For people who want to ask more boring and niche questions on crypto + VC: Given recent developments in private markets and venture, I also tried to do my own homework for a reality check on anecdotes I’ve been hearing (e.g. 1.5-2X markups relative to the median tech startup at early stage, major redirection of talent, tradFi pivots, etc).

I don’t have conclusions to outstanding questions about the role of venture funding in crypto, but attempted to summarize findings - if you have any answers to those questions that are compelling, I may update the below.

Pre-read Resources

These are smarter, better-informed, and more comprehensive takes than mine. They are also things that don’t cost that much time or money to try if you just want to see for yourself, which if you’re like me, is much more helpful than reading about it.

There are better-informed people on the difference between ZK vs Optimistic rollups, the future of bridges, or structuring a SAFT vs a SAFE. I will try to point them out so you can find them if you want to. The below assumes some understanding of the blockchain, Bitcoin / Ethereum, and browser compatibility.

First TODOs

Skim the Block report highlights 2022.

Read Coinbase guide on altcoin and defi tokens.

Try setting up a hot, custodial software wallet for the first time. Do something via a centralised exchange. (e.g. buying something on Coinbase, crypto.com, Binance). 4

Try setting up a hot, noncustodial software wallet for the first time (e.g. MetaMask, Phantom for Sol, Coinbase Wallet). Buy something on a decentralised exchange (e.g. Uniswap for Eth) or send a sum to your non-custodial wallet from your custodial wallet. 5

Bonus - try setting up a cold wallet for the first time (e.g. Ledger Nano X).

Try staking a coin or reading up on a consumer-fintech solution based on crypto for the first time (e.g. Eco, Celsius).

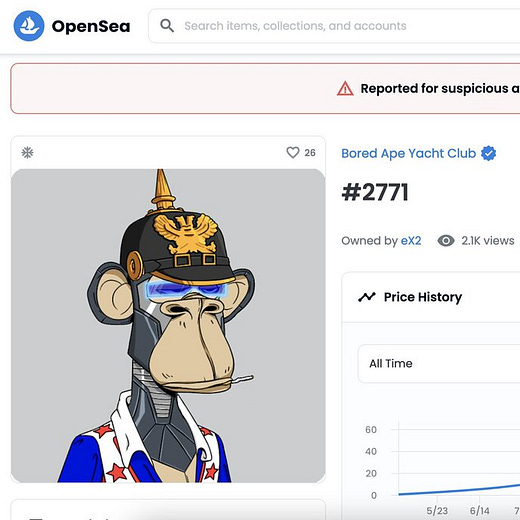

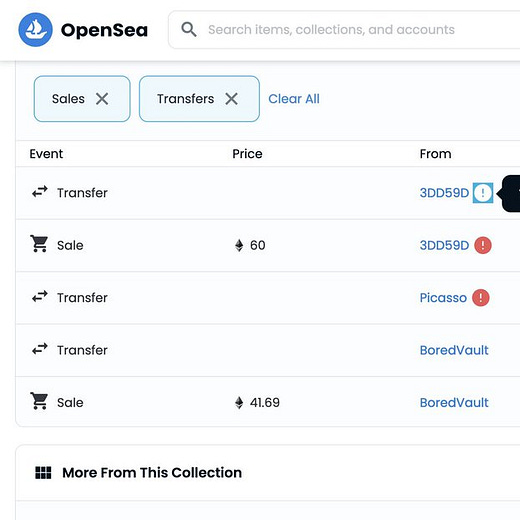

Try buying or listing a NFT for the first time. (e.g. Solsea for Sol, OpenSea for Eth).

Join a DAO (example list here).

Devs: Try building something (e.g. your own DAO in JS, a smart contract in Solidity, your NFT collection on Sol) for the first time via buildspace.so.

Reasons to be skeptical.

Here are some major reasons people are skeptical of the momentum in crypto. (Aka common Q&A from relatives on why crypto won’t disappear in 10 years or stagnate.)

I’ve given my best steel man for the skepticism, and attached my thoughts on how strong each point is in the second bullet point.

Crypto has no “intrinsic” value. Specifically, crypto has no value-add over fiat.

The steelman here was the toughest to articulate - it is easier to show the existence of some value than to show something entirely has no value.

It is fairly straightforward to see, even if you think the coins and the marketplace products themselves hold no value, that cryptocurrencies provide flexibility that is useful to a small portion of the financial industry with a new structure.

A balanced steelman here would make the case that crypto has no “intrinsic” value to the average consumer who isn’t in the financial or trading industry. Mezzanine financing may be a very useful type of debt instrument, but to the average consumer it means nothing. A measure of value here then might be the use of crypto in making purchases the average consumer might want (I’m aware this is a productivity-centric, consumerism position to take, but if you have to fault me something, fault me for using this as the premise).

A low bar to meet for “intrinsic value” is whether crypto would make for easier economic transactions - Nixon unpegging the US dollar from the Gold standard in 1971 was useful to the average consumer, because it allowed for easier flow of money for everyone who would want to make a purchase given the shortage of gold.

A higher bar to meet for “value” is whether the average person can make purchases with crypto, in ways that can’t be done with existing solutions.

The steelman here is that neither bar is met, and that crypto won’t be used for day to day functioning.

One way to see crypto’s value-add is the scale at which crowdsourcing and funding is done - an improvement of 10X in speed, or coordination size, or participant pool, over existing solutions. One post that gave examples was Balaji’s post on what has the blockchain done for us? (e.g. in intermediate international wire transfers, and in crowdfunding efforts).

Here are some examples with coordination size and participant pools:

Opening faster access to international moneyflow. the average consumer in the US can send money to someone located in Venezuela, for roughly the same amount of time and money they can send their neighbour. This is cheaper than using bank infra and sending via SWIFT. See this post on crypto international remittance as a use case.

Opening access to small and expensive marketplaces. The average consumer can sell art digitally, and trace ownership on a public network.

Opening access to large, private ownership. The average consumer can publicly find, and regularly vote on and control large crowdfunded projects that was previously too expensive on an individual level to control (e.g. LinksDAO to own a golf course, KrauseHouseDAO to own a NBA team, CityDAO to control a patch of land in Wyoming.)

Here are some protocol-specific examples (some of these may be considered regulatory arbitrage, see below).

the average consumer can buy carbon credits and vote on policy via KlimaDAO, and fundraise quickly enough to 2X voluntary credit prices in a year.

the average non-US consumer who didn’t have access to US exchanges can buy synthetic assets that track equity markets via the Mirror Protocol on Terra.

Here are some things you can do with fiat you can’t do with crypto.6

Buy things at the grocery store, at the car dealership, or other retail stores

Hand the money to someone else in person

Have your bank flag or cancel your transaction if you suspect you lost your card

There are additionally some advocates for Bitcoin as a store of value in replacement of fiat and gold as an inflation hedge. 7

While there seems to be demand for crypto solutions in the financial industry, we are still in early days for larger consumer demand.

Crypto is legal arbitrage.

The steelman here is that all the benefits of crypto merely arises from “regulatory arbitrage”, or otherwise known as doing something you can’t do in a well-regulated space A in a less-regulated space B (mostly due to how quickly B develops). This is especially true in deFi, where regulations around investing in know your customer (KYC) are just starting to catch up to crypto resulting in lost users, and unregistered swaps fines for exchanges. The flexibility that comes with crypto leads to less recourse for large fraud, and therefore the space is due for regulation soon. A case could be made that benefits or desire to use crypto may disappear once SEC or other regulatory power catches up to crypto.

A lot of the argument countering this take rely on my perspective on the role of regulation, the type of posturing we’re seeing, as well as the Overton window around tech. regulation in the recent 3-5 years. Without passing value judgement on whether this is a good thing, here’s a claim: you can always build faster than a group of people trying to reach consensus or write about what you’re building (i.e. the Heisenberg uncertainty principle applied to regulation). It took 8 years after the initial launch of Bitcoin for regulation to come out on tokens. While this timeline has accelerated in recent years, it is upper bounded by the reactionary speed to building.

The flip-side of regulatory risk here is opportunity: who is going to be the Delaware to LLCs but for DAOs? 8 If regulation for web3 has the chance to be different than web2 for the exact same space, will there be an opportunity for better reform? My other slightly controversial take (again without prescribing value judgement) is: if you do regulatory arbitration well for scale, is it really a headwind? (See history of Paypal early days where fraud prevention should have been part of the equation, but wasn’t, to which its early user audience and success could be attributed, which is a form of regulatory arbitrage. It got bad enough Louisiana banned Paypal.)

Any disruptive change will come with regulatory arbitrage (e.g. any of the FAMGAs brought to court for monopoly in early days). If crypto’s benefits come from speed, or from other values, arbitrage itself is not something to discount it for. This counterpoint is anchored on crypto value add existing in other forms.

Decentralisation is a net good thing BUT crypto isn’t going to be decentralised.

The steelman here is that no matter how generously you cut it, the overwhelming majority of crypto and web3 is not truly decentralised, because layer 0 (or even <0) is not truly decentralised. This is a devastating claim if you consider the only benefit of crypto to be decentralisation to justify the switchover cost (this assume many reasons for why decentralisation, in principle, is a good thing). The centralisation here is sometimes unspoken, and sometimes explicit. Taking out a US-E1 cluster can bring down an entire major crypto project. A DAO beyond a certain size will have a few key organisers who get overwhelming direction on the project. OpenSea (or any centralised exchange or marketplace) will have the same moderation issues centralised platforms had in web2 once they catch up to web2 market share.

Financial advantages (e.g. if you are an investor) will follow from web2 into web3, and a small portion of whale backers and investors may control a large portion of crypto and web3. Vitalik alone can sway the price of Eth if he wanted to. The case here is that crypto doesn’t contribute significantly to decentralisation for the switchover cost from fiat to be worth it.

The comparative is the type of decentralisation - in many ways, it’s not a matter of “decentralisation” but rather the smaller differences between “distribution”. We’re never going to get either extremes of centralisation or decentralisation. At best, we will get a “representative” on-chain decentralised version of our existing world. (E.g. in DAOs we’re already starting to see this type of representative democracy appear in ENS domains where people give their vote to delegates.)

Consider a supply of resources (money, power, thing X). In either a centralised world or decentralised world everyone will have some finite supply of it. The under-justified claim is so long as even a slightly larger of people feel empowered to have agency (e.g. more flexibility, convenience, speed, more thing X, more desire to exercise thing X) in some way, the type of new distribution in crypto is worth the cost.

To see this, if crypto democratised financial knowledge and vehicles in the same ways the Internet democratised information, it’s a net sustainable and good change. There are maybe 3 things you can do on the Internet that you couldn’t do before the Internet with a couple of steps or years added (try naming a few). While decentralisation can be done in existing ways (i.e Robinhood or Wealthfront democratised personalized investing), if crypto supports versions of it that don’t exist right now, it’s a net useful thing. The more interesting dimension here is “who gets liquidity” rather than “how much liquidity”.

Decentralisation is actually a net bad thing, AND the best version of crypto would have the same negative consequences.

The case here is that decentralisation and convenience are opposite each other. This is true right now due to scale of operations, but not intrinsically true to decentralisation. It also is useful to call out the types of decentralisation (political, administrative, fiscal, market). Administrative decentralisation is more convenient at scale (e.g. the most extreme form of devolution is when A sends B something without middle entities), political decentralistation is less convenient at scale but may have other value (e.g. everyone has to vote to decide on something). The case here is that economies of scale runs opposite of “decentralisation”. Multi-chain projects will necessitate having a “central”, or common denominator bridge for scale to play out. The biggest concern is that we converge towards the exact same structure on the Internet, but retain worse performance due to loss of scale.

Here are some example takes on the costs of decentralisation:

The optimistic case here first assumes a bit of anecdotal faith in open-source development at scale as a principle (and with ample evidence that it has worked in the past for what people consider web2, in prominent examples such as operating systems). Developers taking the initiative to contribute to forks and clusters of projects, have worked out the problems with decentralisation, in the majority of cases. It takes a bit of a leap to see how decentralisation benefits DAOs and project governance, but the fun thing with the internet is you can put more (and likely better-informed heads) together to figure it out. (A bit of a cop out, I know.)

Centralisation result in monopolies of some form. Monopolies come with benefits of scale, but price-fixing, quality, and lack of incentive for innovation are many well-understood economic drawbacks. To defend centralisation out of short-horizon convenience is to neglect long-horizon benefits decentralisation bring. For instance, Google has not truly made palpable significant improvements to the quality of its search engine, and there are some arguments it’s degraded over time. Facebook is able to force everyone to download Messenger or remove account handles when it wants to (this is not to say that web3 does not currently have the same problems). If Amazon wanted to push its own products over SMB sellers, it could.

The best case to make about the benefits of decentralisation is positional - unless you’re already in the 1% of authority or power, you don’t have much to lose with true decentralisation. It’s not a big leap to see that if you have an institutional chokehold on resources, there’s no benefit to decentralisation for you. The wild guess I’m making here is that the majority of people in the web2 world, or ones reading this post, are not in that position.

Already we’re starting to see some benefits, in media. A sound.xyz attempting to change how music labels work may give more power to creators, or Discord letting anyone join and see historical community records is useful to those that didn’t have access before. The web2 version of this is YouTube letting many new creators upload, leading to more diverse content and new revenue streams.

The people who argue against decentralisation in web3 likely already, both knowingly or unknowingly, advocated for decentralisation in web2 (e.g. sound.XYZ to YouTube is YouTube to MTV). The same case is made for the people who argue for decentralisation, but also for exclusivity in web3 community. It’s a matter of positional change.

The tough call here again is the extremely high risk in a middle ground - decentralisation is good in principle but bad executed poorly, shifting costs to everyone. You can make many good faith arguments for/counter this (regardless of your positional change), depending on your own mental model for the risk.

Crypto is just momentum.

The steelman here is that a lot of crypto does seem to be momentum - there’s no good case to be made for why DOGE or ConsitutionDAO has the valuation or backing they see if they weren’t fun to support without a crowd behind it (which is what constitute “speculation” or “hype” to most.) Many people won’t be in crypto if the financial incentives weren’t good. The case to be made here is that little progress will survive a winter.

Hype-as-a-product (HaaP) exists in anything - there will be a Gamestop to pour money into in any world, and there will always actors who optimize for gimmicks (and to that I say, let them.) In any market euphoria or innovation, a portion of current users is guaranteed to leave in a winter.

The question here that’s more interesting here is the exact retention percentage and critical mass. Once a space hits critical mass or a milestone, the retention rates will be high enough winter recovery becomes easier (or you can raise enough money and decrease burn rate to survive a winter i.e, Amazon’s recovery post dot com bubble). 9

The key milestones in my mind for crypto are

the average consumer finds it easy to set up a wallet

the average consumer prefers sending cryptocurrency to friends using a deFi wallet rather than sending fiat through Venmo

the average consumer saves via crypto “banks” rather than the bank

Suppose crypto follows the early adoption curve model (2.5%, 13.5%, 34%, 34%, 16%). Right now in the US there is an estimated 16% who has traded crypto. It took the Internet 5 years to be adopted. I am not going to give a number here for crypto milestones, just as I won’t attempt to estimate time to level 5 self-driving or nuclear fusion, because I’ll inevitably be wrong. You can probably get similar back of the napkin math fairly easily (3 growth models for pessimist, middle, optimist).

Crypto deFi solutions break if we have quantum computers.

The steel man here is existing crypto solutions aren’t post-quantum ready, relative to financial institutions. The existing financial system is reliant on AES-256 (or the “bank standard”), which is believed to be quantum resistant. A messaging app (commonly used in crypto communities) like Telegram which uses Diffie-Hellman, or Etherum which uses ECDSA, will break with the right quantum computer.

Some cryptocurrencies are starting to research or deploy quantum resistant versions (e.g. Eth 2.0 may include quantum resistant signatures such as XMSS and SPHINCS to take out ECDSA). There *seems to be* enough developer momentum to outpace the speed of quantum computing development. Keep in mind that NIST and therefore most US standards is still determining a new quantum-resistant algorithm in early 2022.

The metaverse is a dark direction for the world.

I failed to make the case and counter here, because the idea of the Sims-fication of reality is just flat out … unappealing personally. 10 I have yet to meet anyone who is into the concept.

There is sentiment that Metaverse is a tactic for Facebook to reclaim hardware and App territory it lost via smartphones and App Stores, happened to bundle in with crypto momentum (see Benedict Evan’s post here). More interesting cases for VR might be filling gaps in reality (e.g. operating room simulation, security training). More interesting use cases for avatar lives interesting might be bringing back Club Penguin.11 Gamification of reality is not something (77% of those surveyed) many feel compelled to sacrifice ScreenTime for.

However - the success of the Metaverse won’t make or break crypto as a whole.

At the end of the day, it probably doesn’t matter to the markets which world gets the credit, so long as the job gets done - it doesn’t really matter if someone uses Coinbase over Robinhood if they get the same yield, or if someone publishes using mirror.xyz over Substack.12 It doesn’t really matter if you slap a web3 label on a solution, or not. 13 A cryptocurrency that runs on AWS will inevitably be a mix of both worlds, and the disambiguation of the 2 worlds can be both a difficult and silly exercise.

The type of ideological momentum behind crypto isn’t personally compelling, and probably isn’t that compelling to the average consumer in the long run - my horse, and theirs, will be with what gets the job done best. If using (Metamask/Eth) to send 50 units worth of a currency cost 25 units in gas fees, and using (Paypal/USD) costs 2 units, it’s not hard to see which one will get chosen. This is not to say it doesn’t take time and scale to get to a certain goal, but novelty alone may not be enough reason to get there.

There isn’t really a conclusion, except that skepticism presents for opportunity. With 84% of the population not yet on-ramped, it is important to question which sources for skepticism attribute to the biggest adoption gap.

Reasons to be excited.

Here all the reasons I’m still excited about crypto and on-chain solutions (as well as the doubts that I have about them).

Default attitude pro-innovation and change.

If you like change or new technology, you should at least be somewhat excited about (or be able to clearly articulate what you think is missing from) crypto talent. Seeing a large flow of talent from large tech. organisations to new crypto projects and open-source hacking feels like a nice homecoming on what’s rewarded in tech culture.

The majority of crypto and blockchain use cases are in the financial industry. It’d be interesting for some attention to go to the intersection of blockchain use cases for science and other industries. For talent, funding science knowledge via web3 momentum and making it easier to get generalised dev. education seem to be good ways to go. See below on some ways we can get there.

Use cases beyond fintech.

The use case of blockchain falls far beyond decentralised P2P transactions. Under-explored applications include

understanding data exchange and privacy problems (e.g. in healthcare, or biding cases)

looking at on-chain similarities with biological and physical structures (e.g. genomics)

looking at on-chain similarities with looking at information asymmetry in commercial, cross-national projects with large coordination problems (e.g. supply chain)

creating on-chain governance projects for real-world, high-cost bureaucracies (privacy-preserving voting cases, DAOs as a service)

On-boarding as an opportunity.

Given the distribution of early adoption, on-ramping and top-of funnel presents a big opportunity (thread below).

Some other gaps (unfiltered) for mass adoption:

non-custodial, privacy first wallets (with social-based or other forms of backup)

1-tap RFID-based payments hardware (e.g. Stripe Terminal for crypto)

1-tap automated token function guides - what can each token or coin you hold do (e.g. governance, staking) without reading entire developer docs?

well-bucketed crypto S&P index outside of BTC

crypto insurance and fraud recourse for consumers

exchanges for easy internationalization (big exchanges such as Binance and Coinbase are still available based on location)

white labelled Discord with project-specific UI

Outstanding questions for crypto venture.

More involved outstanding questions for people are thinking about BUIDLING and momentum, and timing raises.

Are crypto “exits” faster? How long does it take for the median and average crypto early stage startup to exit (relative to other spaces) ?

The median timeline for a fintech startup is 3 years - if you consider the average crypto startup for a tradFi exit (i.e IPO, M&A), the timeline is in fact, the same.

What makes crypto exits and liquidity a bit more interesting is when token issues are involved. It appears that the average time to token release is 1 year. The average time between funding rounds in early stage ventures is 12-18 months.

The type of exit timing we’re seeing in crypto is then, similar to ones we would see for a tech company (factoring in that venture in 2022 is not the same venture market in 2019), holding revenue and liquidity constant.

Now the question is: how much of the revenue is self-sustaining, or sustained by funding from outside investment? For instance, if the only users a L2 protocol has are all in crypto (and that in turn is backed by venture), and vice versa in another company, such a system isn’t self-sustaining in the long-run. I don’t have a great answer to this since it’s anchored on assumptions for crypto for mass adoption within the financial industry or for consumers.

Hybrid tokenomics and shares - are SAFTs actually a good idea? What mix of tokenomics and shares make the most sense? The tokenomics that come with each mix of token issuing and equity may depend on the exact purpose of the crypto company. A mining company won’t have the same tokenomics that work well for a layer 2 company building on top of ERC-20, or a parachain or bridge protocol.

What is a good way to structure tokens, and bundle their purposes (e.g. governance, staking, API use cases for lending, borrowing, etc.)? Do people actually want to vote with governance tokens? More interestingly - is there a metric that can be the TVL for on-chain governance participation?

Structuring venture funding in crypto, vs. crowdsourcing. It’s fairly evident (and therefore less interesting for me to make the same point) that traditional venture involvement in crypto has increased over the past year or so. My questions here are around the right balance between crypto native communities and venture funding, for each type of crypto project. These concerns are particularly difficult in community based projects (e.g. see OpenSea IPO backlash.) One particular type of information shortage is around initial Dex Offering (IDO), particularly comparability to IPOs.

I did some digging to figure out some of the above exit trends, and present the below without much commentary. Here is IPOs and M&A data I pooled for 2021 via Crunchbase, Pitchbook, and crawling Coinmarketcap, Coindesk, etc, with caveats. 14

2021 Crypto IPOs

2021 Crypto M&As

Screenshot below, happy to share the original analysis and tags with people who are interested.

Distribution of founding date for companies who IPOed or were acquired

Distribution of founding date for companies who issued tokens

Before reading the rest of this post, here are some disclaimers and notes on my position:

You should feel free to fact-check me if anything looks off. I will add corrections with a note.

I hold long positions in certain crypto-currencies, and also in fiat public markets. I spend most of my time in fields that benefit from centralising information, credentials, and authority (AI, science, academia, institutions). I still believe that advances in fields with centralised authority and credentials are very important. I don’t think qualifications are the same thing as credentials, but in some places they seem to be the least worst proxy we have on qualifications.

I’m not speaking on behalf of organizations I work(ed) and invest(ed) for. I link content where I want to, not because I’m sponsored, told to, or necessarily agree with author stances.

Note from a good comment: this post isn’t meant to be FUD. It’s meant to be a nuanced take that help you make a decision on inroads you can work on, which gaps to look at, or decide on whether you want to spend time in crypto. (I’m sorry I wrote you such a long post, I didn’t have time to write a short one.) At the end of the day, you can see that I’m excited by building in crypto (and have taken a side) despite the skepticism perspectives here. I think a strong bias towards action and a healthy dose of skepticism can exist and should exist at the same time, and it’s important to switch between “move fast and break things” mode and “here are all the ways this won’t work” mode, so you can troubleshoot. Anything that is worthwhile and sustainable can withstand some skepticism here and there.

Thank you: Thanks to people who gave feedback and notes! Feel free to drop me a note, thoughts always welcome. Happy to share the crypto startup exits data and rounds info. I pooled with people who would find it helpful, especially people who are building.

The 2013, 2016 and 2020 crypto crowds are very different. If you were in the 2016 wave but not in the 2020 wave (or if you came back to it after a pause), my DMs are open to why this is the case. I am also especially curious to talk to smaller portions of the demographic (e.g. risk-seeking Gen-zs who aren’t interested in crypto, and risk-averse Gen-xs who are interested in crypto). For instance, If you put most of your fiat money on S&P and most of your crypto allocation on altcoins and NFTs, or if you actively invest in fiat micro caps and forex but don’t touch crypto, I would love to hear from you! Understanding what it takes to de-risk trying new things in general is interesting to me.

I’m not going to try to convince you on whether you should spend more or less time in crypto., but my position is probably evident from this post.

Crypto has exciting potential, but I think much is missing from the current momentum for it to onramp half or more of the population. I believe a winter is coming, but I don’t know when. My uninitiated take, is not that soon, and some better-informed researchers linked in this post agree. In other words, I’m a skeptic, but hopefully less of a critic. Criticizing new things is easier than doing doing the new thing, and I welcome corrections if you think I misrepresented certain lines of work here (there’s a P!=NP joke here but I will refrain).

I am excited by only a small portion of projects we see in the space, but am excited by the level of talent and interest we’re seeing. I personally would be very excited to see progress in certain directions, and would spend all of my time in the space if I find good answers to outstanding questions.

The straw man cases don’t really interest me (e.g. engaging Keanu Reeves on why NFTs are not just “right click saves”, or engaging DOGE proponents on why diamond hand threads are not moat). It’s especially easy to make straw man cases for anything new, since uncertainty itself is always a headwind.

For people who are coming across custodial vs non-custodial (self-custodial) for the first time, custodial = the platform has your private keys, non-custodial = you write down your own private keys. For instance, you save your own private key when you sign up for a Coinbase cold wallet (non-custodial), whereas on Coinbase when you buy coins it implicitly saves your key for you (custodial). Coinbase exchange is custodial, whereas Uniswap is non-custodial (referred to as a DEX).

If you want to play with a smaller amount or don’t want high gas fees, playing around with an altcoin like Solana or Terra for the first time could be a good idea. You can also try with Polkadot, but right now it doesn’t really have enough dev support for it to be easy for onboarding.

It’s interesting to consider how much of it is intrinsic to fiat, and how much of it is interesting to “trust” in the consensus of something having value.

I’m not going to touch whether Bitcoin is a better store of value or as an inflation hedge against the dollar. See page 160 in the Block's report for more, and read the Everything Bubble on recession predictions.

Wyoming or Miami might be, we shall see.

The dot-com bubble lasted around 2 years. There’s concern that crypto dot-com bubble 2.0. Assuming that we are, it’s interesting to consider Fred Wilson’s quote (he lost 90% of net worth in the bubble): “A friend of mine has a great line. He says ‘Nothing important has ever been built without irrational exuberance’. Meaning that you need some of this mania to cause investors to open up their pocketbooks and finance the building of the railroads or the automobile or aerospace industry or whatever. And in this case, much of the capital invested was lost, but also much of it was invested in a very high throughput backbone for the Internet, and lots of software that works, and databases, and server structure. All that stuff has allowed what we have today, which has changed our lives … that’s what all this speculative mania built.” He advises not going all in to speculative bubbles.

In the dot-com bubble, it was possible to IPO without steady revenue or profitability. The fragility especially came from heavy net operating losses in marketing to optimize for growth and future profitability.

I like the outdoors, physical things, and technology with good haptics (no one can convince me to give up my old phone with touchID). I am more interested in Terraforming Mars, period, than Terraforming Mars in the Metaverse. New tech. for the sake of new tech is not interesting to me personally, and it’s difficult to try to make a case for recreating a universe at the cost of the old one.

Cue rightfully deserved hate from gamers. Maybe I’m no fun but Meta will have to do better than Horizon World Workrooms.

Web2 and web3 solutions don’t have to compete, but they are de facto competitors right now. Is the same firm allowed to invest in both Mirror and Substack? The answer is apparently yes. Will I get blocked on Twitter for this footnote, only time will tell. (If anyone referenced unexpectedly made it all the way here, leaning into the blocking is the right way to go.)

Pragmatism is no fun but I never promised fun.

This is meant to be a comprehensive list, with a couple of caveats, including but not limited to 1. excluding acquisitions by Crypto companies that aren’t based with crypto tech. (e.g. Coinbase buying Agara, a customer support chat bot) 2. Consultancies and and holding companies. Some descriptions in Pitchbook and CB are not up to date, and my analysis might miss some categorizations.

Friend sent this to me- amazing read. Thank you for all the work you put into it. Very organized